Agricultural Tax Exemption Virginia . Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing.

from www.signnow.com

Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals.

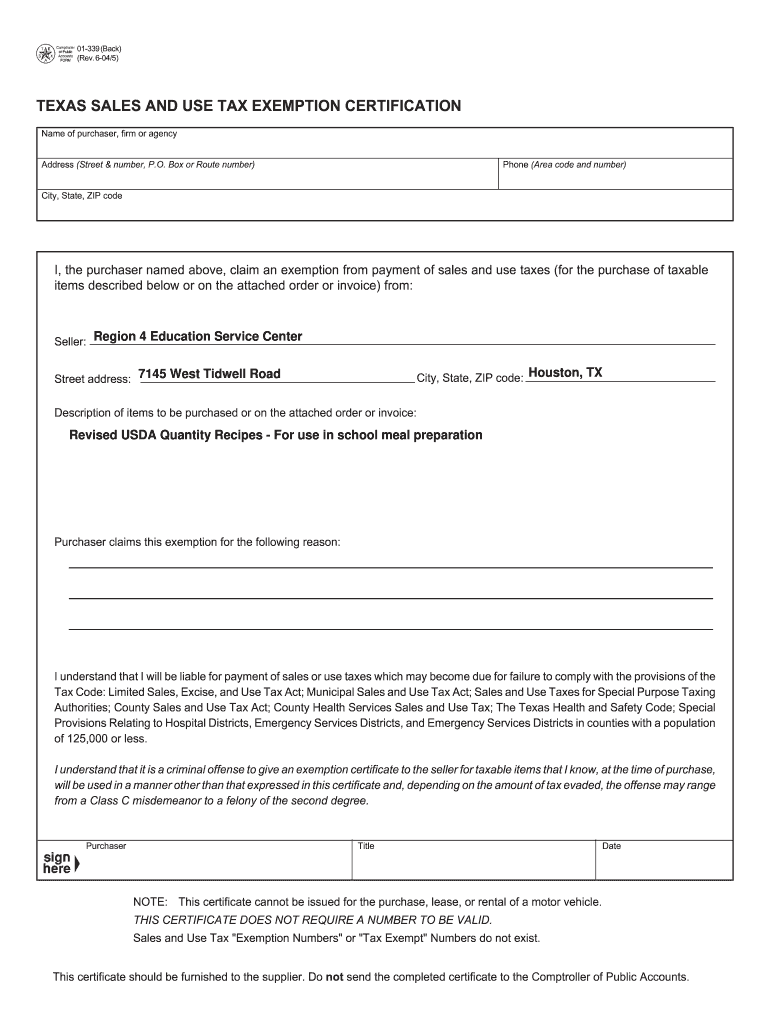

Usda Tax Exempt Form Complete with ease airSlate SignNow

Agricultural Tax Exemption Virginia Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs.

From www.exemptform.com

Form St 8f Agricultural Exemption Certificate Printable Pdf Download Agricultural Tax Exemption Virginia Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web information for farmer. Agricultural Tax Exemption Virginia.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Agricultural Tax Exemption Virginia Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web information for farmer — this certificate of exemption applies only to the. Agricultural Tax Exemption Virginia.

From www.formsbank.com

Form Reg8 Application For Farmer Tax Exemption Permit printable pdf Agricultural Tax Exemption Virginia Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web virginia offers sales. Agricultural Tax Exemption Virginia.

From www.formsbank.com

Form St8f Agricultural Exemption Certificate For Sales And Use Tax Agricultural Tax Exemption Virginia Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web. Agricultural Tax Exemption Virginia.

From www.exemptform.com

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable Agricultural Tax Exemption Virginia An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain. Agricultural Tax Exemption Virginia.

From www.exemptform.com

Agricultural Tax Exemption Form Sc Agricultural Tax Exemption Virginia An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to. Agricultural Tax Exemption Virginia.

From www.exemptform.com

Tax Exempt Form For Agriculture Agricultural Tax Exemption Virginia Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses.. Agricultural Tax Exemption Virginia.

From www.formsbank.com

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In Agricultural Tax Exemption Virginia Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management. Agricultural Tax Exemption Virginia.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Agricultural Tax Exemption Virginia Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web. Agricultural Tax Exemption Virginia.

From learningschoolluchaku4.z4.web.core.windows.net

Sales Tax Exemption Certificate Sample Agricultural Tax Exemption Virginia Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to. Agricultural Tax Exemption Virginia.

From printableranchergirllj.z22.web.core.windows.net

Virginia Estate Tax Exemption 2024 Agricultural Tax Exemption Virginia An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web virginia offers sales. Agricultural Tax Exemption Virginia.

From www.youtube.com

NEW Agriculture Tax Exemption Certificate YouTube Agricultural Tax Exemption Virginia Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web virginia offers sales and use tax exemptions for use by a farmer for purchase of tangible personal property for use in producing. Web information for farmer — this certificate of exemption applies only to the items of tangible personal. Agricultural Tax Exemption Virginia.

From www.templateroller.com

Form DCR199106 Fill Out, Sign Online and Download Printable PDF Agricultural Tax Exemption Virginia Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web virginia offers sales. Agricultural Tax Exemption Virginia.

From www.fmcsa.dot.gov

Agriculture Exemption Diagrams FMCSA Agricultural Tax Exemption Virginia Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open. Agricultural Tax Exemption Virginia.

From www.youtube.com

Agriculture Exempt from Tax YouTube Agricultural Tax Exemption Virginia Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to. Agricultural Tax Exemption Virginia.

From corpbiz.io

An Overview on Agriculture Exemption from Tax Agricultural Tax Exemption Virginia Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses.. Agricultural Tax Exemption Virginia.

From www.youtube.com

Tax Exemptions to Agricultural Sector Relief for Agrobased Industry Agricultural Tax Exemption Virginia Web this certificate is used by farmers to avoid paying tax on a variety of items including feed and supplies needed to raise animals. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses.. Agricultural Tax Exemption Virginia.

From www.morningagclips.com

S.C. introduces card for agricultural sales tax exemptions Morning Ag Agricultural Tax Exemption Virginia An income tax credit equal to 25% of the first $70,000 spent for approved agricultural best management programs. Web information for farmer — this certificate of exemption applies only to the items of tangible personal property. Web 2 virginia code actually allows for use value taxation in agricultural, horticultural, forestal, and open space uses. Web this certificate is used by. Agricultural Tax Exemption Virginia.